dependent care fsa rules 2021

Prior guidance provided flexibility to employers with cafeteria plans through the end of calendar year 2020 during which employers could permit employees to apply unused health FSA amounts and dependent care assistance program amounts to pay for or reimburse medical care or dependent care expenses. The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck.

How The American Rescue Plan Act Of 2021 Impacts Dependent Care Assistance Programs Word On Benefits

If you have a dependent care FSA pay special attention to the limit change.

. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday. Dependent Care FSA Increase Guidance. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only.

The guidance also illustrates the interaction of this standard with the one-year increase in the. You can contribute up to 10500 to your child care FSA in 2021 up from 5000 according to the IRS. If you are divorced only the custodial parent may use a dependent-care FSA.

ARPA Dependent Care FSA Increase Overview. For 2022 and beyond the limit will revert to 5000. For married employees filing separate returns the maximum amount is increased to 5250 up.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. If a child turned 13 in the 2020 plan year AND the. You can use your dependent care FSA to pay for qualified expenses through your dependent childs 14 th birthday.

2021-R-0054 February 11 2021 Page 3 of 4 unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42. WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable. The Taxpayer Certainty and Disaster Tax Relief Act.

For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. On January 14 2021 the Health Service Board approved the following three changes to Child Care Dependent Care FSAs for plan year 2021. Dependent Care FSA Eligible Expenses Care for your child who is under age 13.

Generally you can only use DCAP for children age 0-12 years not yet reached their 13 th birthday. As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. For 2021 the American Rescue Plan Act of 2021 enacted March 11 2021 made the credit substantially more generous up to 4000 for one qualifying person and 8000 for two or more qualifying persons and potentially refundable so you might not have to owe taxes to claim the credit so long as you meet the other requirements.

All eligible employees can make the following changes to their 2021 Child Care Dependent Care FSA once without a. This was part of the American Rescue Plan. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March.

The limit will return to 5000 for 2022. Eligible children for whom expenses can. The details For starters the limit on contributions to dependent-care FSAs is much higher in 2021 under the newest legislative relief package.

Double check your employers policies. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. Employers can choose whether to adopt the increase or not.

Flexible Mid Year Elections. The most money in 2021 you can stash inside of a dependent-care FSA is 10500. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500.

But employers may offer either a grace period or a carryover but not both to health FSA participants under certain circumstances. Dependent care FSA increase to 10500 annual limit for 2021 June 17 2021 On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. For married couples filing joint tax.

If you carry over any balance from 2020 to 2021 the age 14 rule applies to that money as well. The limit is expected to go back to 5000. With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses.

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System

What Are The Benefits Of Having A Section 125 Premium Only Plan Employers Paying Premiums Through A Premium Only Pla How To Plan Free Quotes Insurance Premium

What Is A Dependent Care Fsa Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Fsa Motivational Letter Encouragement Quotes Inspirational Quotes For Employees Letter Of Encouragement

Get The Filing The Fafsa Book For Free Edvisors Fafsa Life After High School Free Books

Explore Our Sample Of Child Care Expense Receipt Template Receipt Template Child Care Services Receipt

Usps Shipping Label Template Word New Whats It Going To Cost You Solo Practice University Best Templates Ideas B Receipt Template Label Templates Templates

Browse Our Image Of College Tuition Receipt Template Invoice Template Receipt Template School Tuition

Free Tithes Receipt Template Pdf Example Receipt Template Letter Template Word Invoice Template Word

Explore Our Sample Of Tuition Fee Receipt Template Receipt Template School Fees Tuition Fees

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Changes To Dependent Care Fsas And What To Know

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Assistance Program Optum Financial

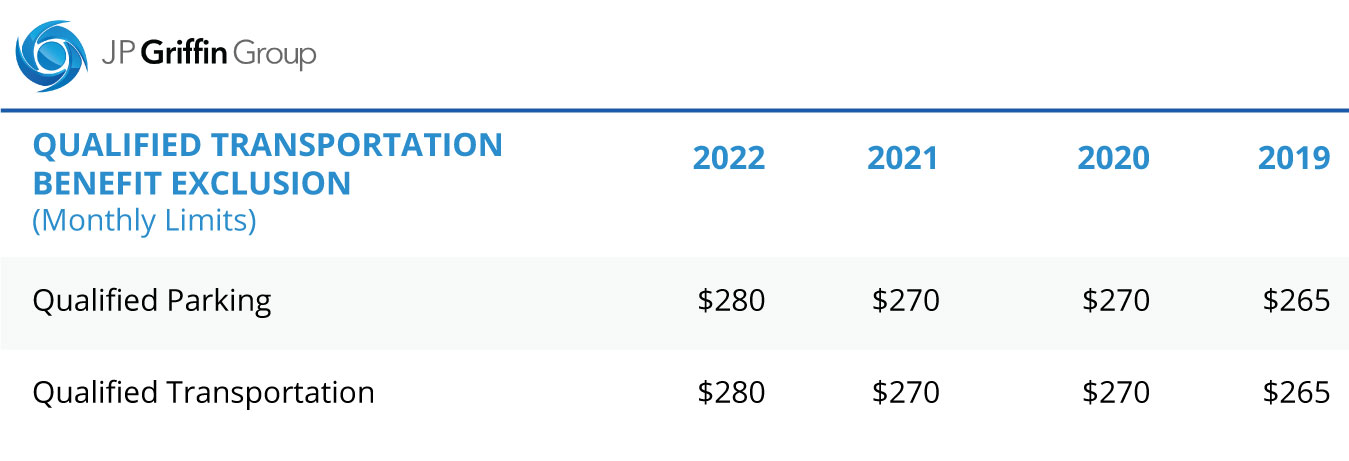

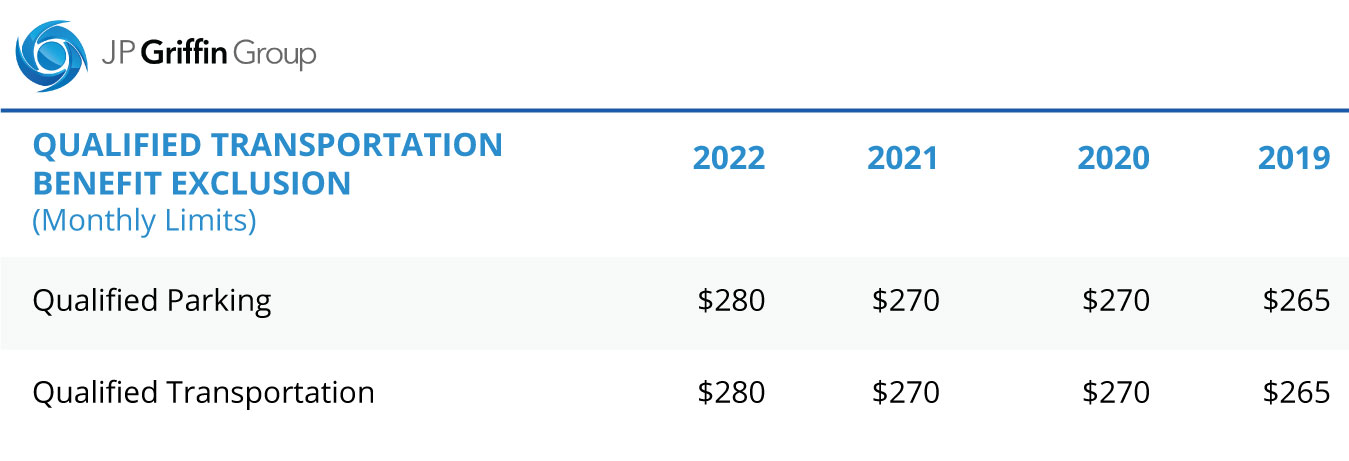

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning